Newsletter n°99

NEWSLETTER

FINANCIAL COOPERATIVE OF INTERNATIONAL CIVIL SERVANTS

N° 99 / October 2025

Something new is coming soon...

A new digital experience is coming to AMFIE. Over the past year, our team has been working to redesign our online tools to offer members a more modern, seamless and intuitive platform.

This transformation also comes with a refreshed visual identity that reflects AMFIE’s evolution and the strong connection we share with our members.

And because AMFIE belongs to you, we want you to take part in this key milestone: help us choose the new AMFIE logo.

Vote for my favorite logo

Missions follow-up

Over the past few weeks, our representatives have continued their tour across Europe, meeting international civil servants and strengthening AMFIE’s ties with key organisations.

From Geneva to Madrid, with stops in the Hague and Valencia, Janine, Svend and Cosimo have pursued their commitment to promoting AMFIE’s financial solutions tailored to the needs of international civil servants.

Their recent visits included the European Organization for Nuclear Research (CERN) in Geneva, the United Nations Office at Geneva (UNOG), the International Telecommunication Union (ITU) as well as the United Nations World Tourism Organization (UNWTO) in Madrid and the United Nations Global Service Centre (UNGSC) in Valencia.

In September, Janine alongside Giancarlo took part in the AHRMIO Annual Conference, hosted this year by Bocconi University in Milan. This event brought together HR and management professionals from across the UN system and beyond, fostering exchanges on the future of talent development in international organisations.

These missions reflect AMFIE’s ongoing commitment to being close to its members and partners, wherever they are in the world.

Working for an intergovernmental organisation : what does it mean for your taxes?

If you work for an intergovernmental organization, you may already know that your salary is often exempt from national income tax. This exemption is usually defined by the headquarters agreement between the organization and its host country.

However, being exempt from income tax does not mean being exempt from all tax-related obligations. There are still important aspects to consider when it comes to declaring and managing your income.

Filing your annual tax return

Even if your employment income is tax-exempt, you are still required to file an annual tax return in your country of tax residence. This declaration allows tax authorities to verify your overall situation and any other income sources you may have.

![]()

Declaring your investment income

Investment income generated through AMFIE is not taxed in Luxembourg, in accordance with local legislation. However, it must still be declared in your country of tax residence, regardless of your status as an international civil servant or the exemption applied to your salary.

![]()

Understanding your tax residence

Your tax residence is the key factor that determines your obligations. It is not influenced by the location of your organization or the tax exemption on your salary. Understanding where you are considered a tax resident is therefore essential to ensure compliance with the applicable rules.

![]()

In summary

Navigating the intersection between international employment and national tax laws can be complex. By staying informed and declaring all relevant income correctly, you can ensure that your situation remains transparent and compliant.

Reminder - Upcoming changes to your AMFIE credit card

Starting January 2026, a few updates will apply to your AMFIE credit card to ensure the long-term sustainability and security of our services.

If you own a Visa Classic credit card, an annual contribution of €15 will now be applied due to a major increase in service provider fees. This amount will automatically be debited during your card’s anniversary month.

For all credit cards, the amount held in you remunerated blocked account will be adjusted to twice your monthly spending limit. This measure follows a few exceptional cases of non-payment by certain members, and aims to strengthen collective security and ensure fairness among all members.

The funds placed in the “credit card blocked account” are remunerated at the rate of a 12-month term deposit in the same currency. Please make sure your account remains sufficiently funded before the end of 2025.

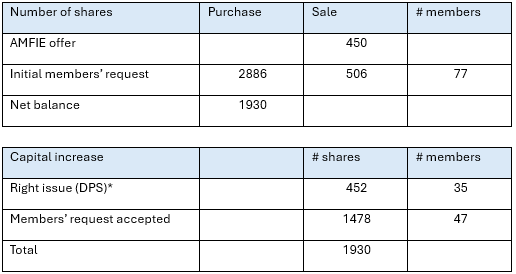

Result of the sale of ordinary shares

Our annual market once again recorded strong participation, with a demand exceeding the offer of 1,930 shares.

The capital increase has contributed to strengthening the Association’s reserves, reflecting the continued confidence of members in AMFIE.

Nearly 23% of the shares were acquired through the exercise of preferential subscription rights (PSR), confirming the commitment of existing members to the development of their cooperative.

We warmly thank all members for their trust and active participation in this operation, which reinforces AMFIE’s solidity and long-term growth.

4th quarter 2025 yields

The Board of Directors has set AMFIE's interest rates on savings accounts, 0/18 savings accounts and term deposits.

FIND MORE ON

https://www.amfie.org/en/amfie-academy

FINANCIAL COOPERATIVE OF INTERNATIONAL CIVIL SERVANTS

25A Boulevard Royal - L-2449 Luxembourg