Newsletter n°95

NEWSLETTER

FINANCIAL COOPERATIVE OF INTERNATIONAL CIVIL SERVANTS

N° 95 / December 2024

All I want for Christmas is…

Santa Claus is back travelling the world with his appraised and ecologically powered sleigh. While waiting for his journey filled with many dreams and aspirations for all, we will explore in this letter the impact of Donald Trump's election on interest rates with his economic policies influencing market expectations, hence highlight the importance of financial diversification in investment strategies and share the outcome of AMFIE’s recent stock sale reveals strong market interest and sets the stage for the company’s next growth phase. We will also cast a glance at our Capitol Gold card advantages.

We wish you all wonderful moments of happiness with your family.

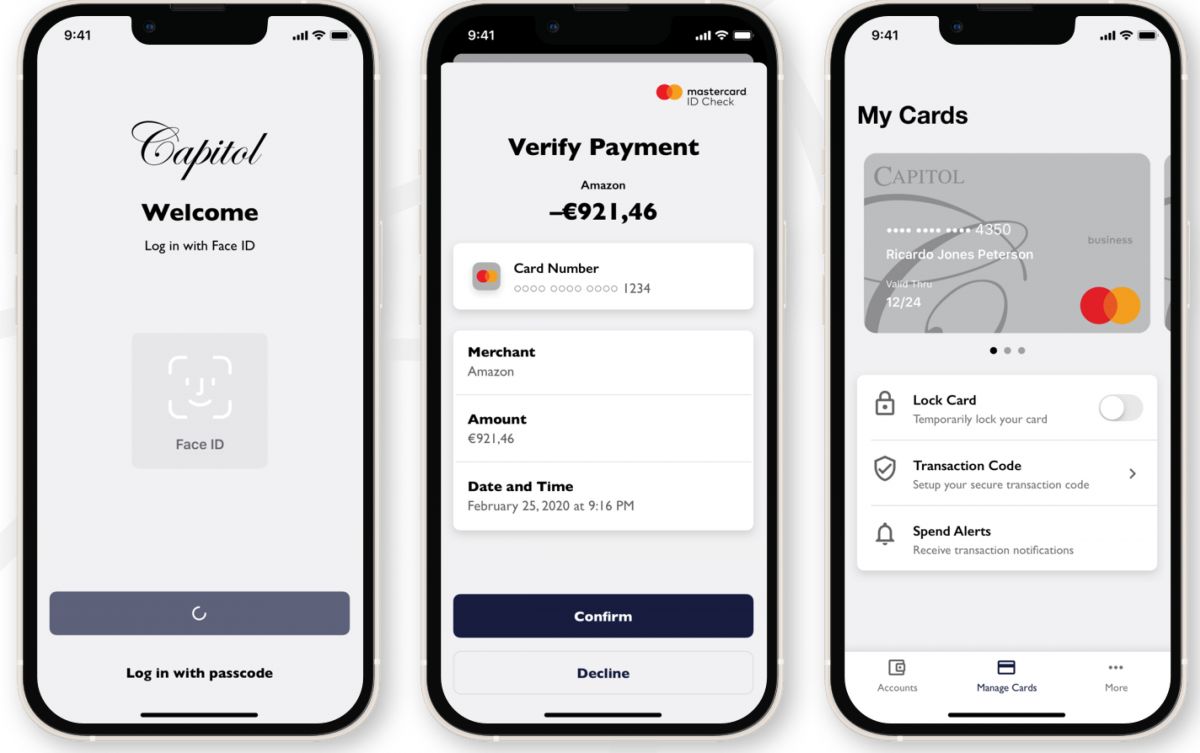

BIL cardholder, it’s time to upgrade to the Capitol Gold card

Why switch to the Capitol Card? A simple, economical and efficient solution!

If you are a BIL cardholder, it may be time to discover everything the Capitol card can offer you. Here's why the Capitol card is an ideal solution for managing your daily payments.

1. Reduced costs: start saving now

A Gold card at half price! AMFIE covers almost half of the annual fee, so the card only costs you €55/year. This new solution allows you to reduce your costs while benefiting from modern and optimized services.

2. A powerful application to simplify your transactions

With the Capitol card, managing your payments becomes child's play, thanks to a dedicated application:

Easy online transactions: Make your purchases with complete peace of mind.

Real-time expense tracking: Instantly access your transactions to keep an eye on your budget.

Autonomous limit management: Increase or decrease your monthly limit in just a few clicks.

Real time card blocking: In the event of loss or theft, block your card directly from the application.

3. A quick and effortless transition

Switching to the Capitol card is quick and easy:

- Fill out an online form.

- Send it by email to operations@amfie.org

- Receive your new card in about a week (Postal delays may vary depending on your reception location).

Once received, we will take care of canceling your BIL card. No interruption of service: you will never be without a bank card!

Take advantage of the benefits of the Capitol card and contact us today to begin the transition and take a step towards simplified management of your finances. The Capitol card: less expensive, more practical, more efficient.

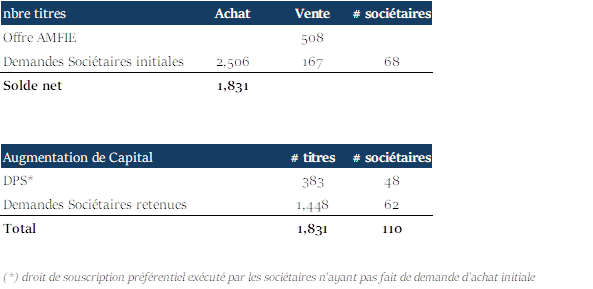

Result of the Sale of ordinary shares

Our annual market was very dynamic with demand exceeding supply by 1,831 shares. The capital increase carried out added an approximate €160,000 to our association's reserve. It should also be noted that nearly 31% of the shares were acquired by exercising preferential subscription rights.

We thank you for the trust you have all shown in AMFIE and its teams.

Smart Wealth Management for Beginners

The Benefits of Diversifying your Assets Beyond Savings Accounts and Term Deposits

For many of us, saving money means one thing: putting it in a savings account or maybe a term deposit. After all, these types of accounts offer stability and easy access to our funds, making them a safe choice. However, in today’s financial world, sticking solely to savings accounts and term deposits might not be the best way to grow your wealth over the long term. If you’re looking to make your money work harder for you, it may be time to consider other options, like investing a portion of your portfolio in stocks and bonds.

This article will explore why putting all your money into traditional savings vehicles can limit your financial growth and how introducing stocks and bonds, often through investment funds, can enhance your financial future.

Why Relying Solely on Savings Accounts May Hold You Back

Savings accounts and term deposits are great for security but less ideal for growth. Here’s why:

- Low Returns: Savings accounts and term deposits offer interest rates that, while stable, tend to be low—often below the rate of inflation. Inflation is the gradual rise in prices over time, and if your savings account pays less interest than the inflation rate, the real purchasing power of your money can shrink. In other words, you might actually lose money in the long run.

- Lack of Growth Potential: These accounts are designed for safety, not growth. While they offer low risk, they also come with low returns. In contrast, the stock and bond markets have historically offered higher returns over time, though they do come with ups and downs along the way.

- Missed Opportunities for Diversification: Savings accounts and term deposits are just one type of financial tool. A well-balanced portfolio—a mix of different investments—can offer more stability and growth by spreading your risk across multiple assets, such as stocks, bonds, and cash.

Exploring Stocks and Bonds: The Growth Engines of Your Portfolio

To balance safety and growth, it’s wise to consider adding stocks and bonds to your investment mix. Here’s a quick rundown on what they are and why they’re worth including:

- Stocks: When you invest in stocks, you’re buying a small piece of a company. As the company grows and makes profits, your share can increase in value, and you might receive dividends (a portion of the company's earnings). Stocks can be volatile, meaning their prices can go up and down, but they also offer the potential for significant long-term growth.

- Bonds: Bonds are a form of lending. When you buy a bond, you’re essentially loaning money to a company or government, and in return, you receive regular interest payments until the bond "matures" (ends). Bonds are generally more stable than stocks but usually offer lower returns. They act as a “safer” investment compared to stocks, helping balance risk.

The Power of Investment Funds: An Easier Way to Diversify

For those new to the world of investing, navigating the stock and bond markets can seem complex. This is where investment funds come in handy.

Investment funds pool money from many investors to invest in a diversified mix of stocks, bonds, or both. Here’s why they’re a good choice for beginners and seasoned investors alike:

1. Instant Diversification: When you buy shares in an investment fund, you’re buying a small piece of a variety of investments. This built-in diversification can reduce your risk because it spreads your money across multiple companies, industries, or bond issuers. If one stock or bond performs poorly, it’s balanced by others that may perform better.

2. Professional Management: Most investment funds are managed by financial experts who make investment decisions on your behalf. They analyze market trends, select stocks and bonds, and adjust the fund’s holdings to align with the fund’s goals. This professional oversight can make investing easier and potentially more profitable than choosing individual stocks or bonds on your own.

3. Flexible Options: Investment funds come in many varieties, each with different levels of risk and return. Some funds focus on stocks for growth, others on bonds for stability, and some are balanced funds that include a mix of both. This flexibility means you can choose a fund that aligns with your comfort level and financial goals.

Finding the Right Balance for You

For most people, a balanced portfolio includes a mix of savings, bonds, and stocks. Here's a simple way to think about it:

- Savings: Good for emergencies and short-term goals (like vacations or big purchases within the next few years).

- Bonds: Typically used to provide a stable income and reduce overall risk. They’re less volatile than stocks but offer better returns than a savings account.

- Stocks: Best for long-term growth. Stocks can go up and down, but historically, they tend to perform well over the long term. Periods of interest rates cuts are usually positive for the stock markets.

So how do you decide what’s right for you? It mainly depends on your financial goals and comfort with risk. Younger investors may lean more toward stocks for growth, while those closer to retirement might prefer bonds for stability.

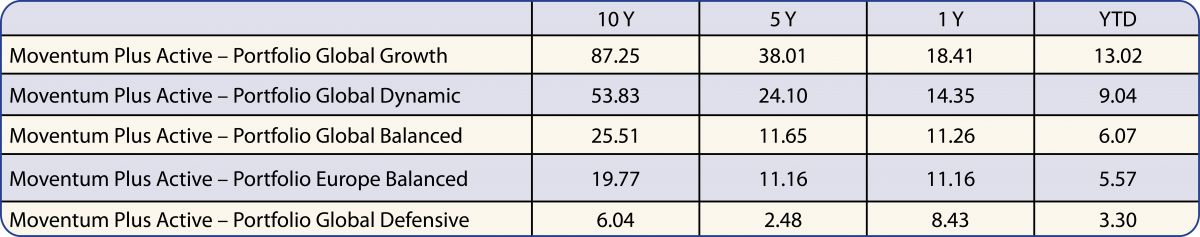

Final Thoughts: Start Small and Grow with Confidence

Investing in stocks and bonds through funds doesn’t require a huge initial sum. Many funds allow you to start with just a small investment (AMFUND for instance is possible with only EUR 50), making it accessible for everyone. By gradually adding to your investments and re-evaluating your portfolio as your life changes, you can build a strong financial future.

Savings accounts and term deposits offer security, but by branching out into stocks and bonds through investment funds, you open the door to greater potential growth. Take it one step at a time, and watch your money grow beyond the boundaries of a traditional savings account.

credit photo @conttonbro

Note: All investments carry some risk, so it’s essential to do your research to understand which investments are best suited for your financial journey. AMFIE is not allowed to provide advices, but if you wish general information about the markets and the way financial products work in general, you can reach out to us.

Source: Morningstar Direct *Performance according BVI Method. Past Performance is no guarantee for future results. The value of investments is subject to price fluctuations.

Yields for the 4th quarter 2024

The Board of Directors decided on the yields on AMFIE returns on savings accounts, 0/18 savings accounts and term deposits.

Trump Presidency 2: What are the consequences for the international civil servants?

A second Trump term: what implications for the international civil servants?

Donald Trump's return to the presidency of the United States raises many questions about the future of international organizations and their collaborators, whether civil servants or consultants. This context could also be accompanied by significant economic changes that international civil servants will have to anticipate in their wealth strategy.

credit photo Carlos Herrero

Possible repercussions on international organizations

During his first term, Donald Trump had expressed criticism of certain international organizations, calling for reforms. This criticism had translated into decisions such as the withdrawal of the United States from the UN Human Rights Council, UNESCO and the WHO, although these measures were later reversed by Joe Biden. In addition, delays in financial contributions and reductions or suspensions of funding for specific agencies, such as UNRWA and UNFPA, had also been observed.

Donald Trump had also proposed a 30% reduction in US funding to the UN, a measure blocked at the time by Congress. However, if a second term were to coincide with an aligned parliamentary majority, budgetary changes could be facilitated. These possible developments could modify the financing and functioning of international organizations. At the same time, some observers believe that other international actors could adjust their contributions to compensate for possible US withdrawals.

Economic directions likely to influence the markets

On the economic front, Donald Trump's second term could be part of a continuation of the "America First" doctrine. Measures such as increasing customs duties on certain European and Asian products could accelerate reindustrialization in the United States, initiated under the Biden administration, as well as the development of "friend-shoring" strategies in Mexico to diversify supply chains.

In the field of ecological transition, a slowdown in initiatives could be envisaged, to the benefit of sectors such as extractive industries, New Space, technology, robotics, artificial intelligence or crypto-assets. Regarding monetary policy, relations between Donald Trump and the Federal Reserve (FED) could remain complex. Although the FED is independent, divergences on the pace of interest rate cuts could indirectly influence overall economic policy.

FIND ALL THE ARTICLES ON

https://www.amfie.org/en/amfie-academy

FINANCIAL COOPERATIVE ASSOCIATION OF INTERNATIONAL CIVIL SERVANTS

25A Boulevard Royal - L-2449 Luxembourg