AMFIE ACADEMY - Understanding non-complex bonds

AMFIE ACADEMY Understanding non-complexe bonds

The diversity of non-complex bonds on the market means that they can be a suitable investment for a variety of investor profiles. But what exactly are non-complex bonds?

To cover financing costs, companies have a range of options. They can issue capital through shares, debt through bank loans, or debt directly to investors by issuing bonds. Once you have acquired a bond, you own a debt security, issued by a government, company or an international organization.

Most non-complex bonds have a ‘maturity’ (bonds without a maturity are called perpetual bonds). A maturity is a fixed term at the end of which your capital will be repaid (provided that the issuer has not defaulted).

Most bonds come with coupons. The coupon is a percentage of the face value of the debt and is paid over the course of the bond’s term (usually yearly or half-yearly). Coupons can be either fixed-rate (determined at the time of the issuance) or variable-rate. The advantage of a variable rate bond is that the price is not exposed to interest rate risk because its coupon is indexed to the market rate.

A third type of bond is a zero-coupon bond, which does not distribute coupons, but instead accumulates interest that will be paid at maturity. These bonds offer a higher final repayment than their issue price, so your return is generated by the difference between the price that you pay to purchase the bond and what you receive at maturity.

Recently issued bonds (that are not zero-coupon bonds) on the primary market are generally issued ‘at par’ (i.e. at 100 percent of their face value). Later, they will be traded on the secondary market at a price expressed as a percentage, reflecting the bond’s attractiveness to investors.

One advantage of investing in bonds is that the investor knows in advance the return on investment. This return is called the ‘yield to maturity’ and will vary depending on the price of the bond. When investors push up the price of a bond, yield to maturity decreases. This generally happens when interest rates fall. At this point, older bonds will become more attractive, given that they yield more than their recently issued counterparts.

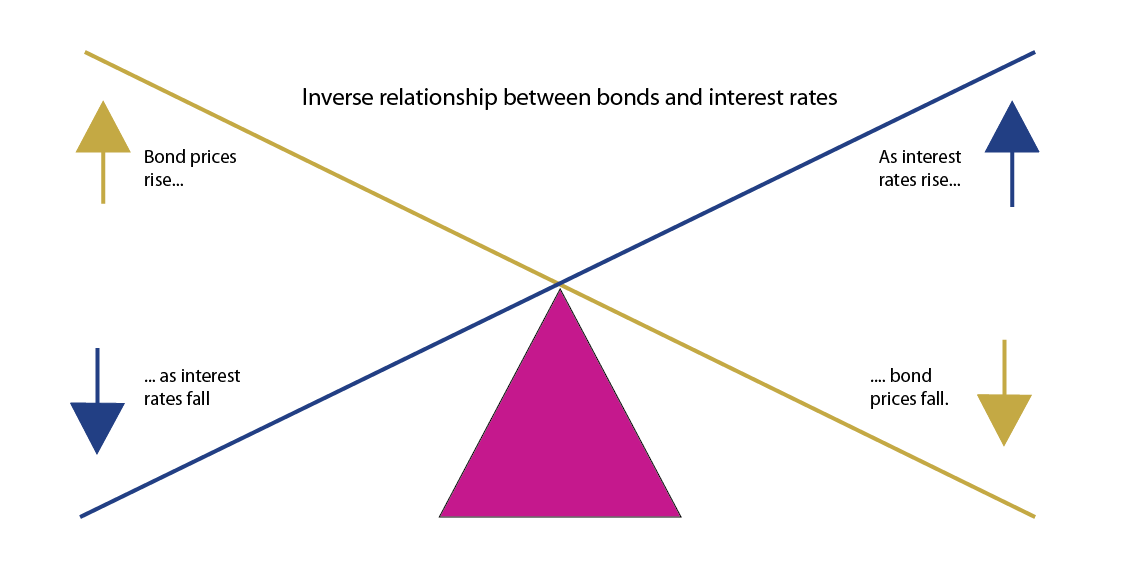

On the other hand, if investors lack of interest leads to a drop in the bond price, yield to maturity increases. The value of a bond generally declines when interest rates rise because it becomes more attractive for investors to purchase the most recent issues of a similar quantity that offer a better return. In other words, there is an inverse relationship between bonds and interest rates.

In our next issue, we will look at the different types of risk associated with bonds, as well as the rating agencies that attempt to measure the quality of different bonds.

This article is provided for educational purpose only and on the basis that you make your own investment decisions and do not rely upon it. AMFIE is not soliciting any action based on it and it does not constitute a personal recommendation or investment advice.As part of AMFIE's cash management - Off Balance, the Association excludes all speculative products (Commodities, precious metals, options, convertible bonds). The categories of financial products in which AMFIE may invest are listed in Article 4 of the discretionary management mandate.