AMFIE’s cash management for the year 2019

Cash management: the Managing Director’s point of view

Things were simpler in the past. But the interventions of central banks and, particularly, the quantitative easing of the European Central Bank in March 2015 have led to the current period of negative returns.

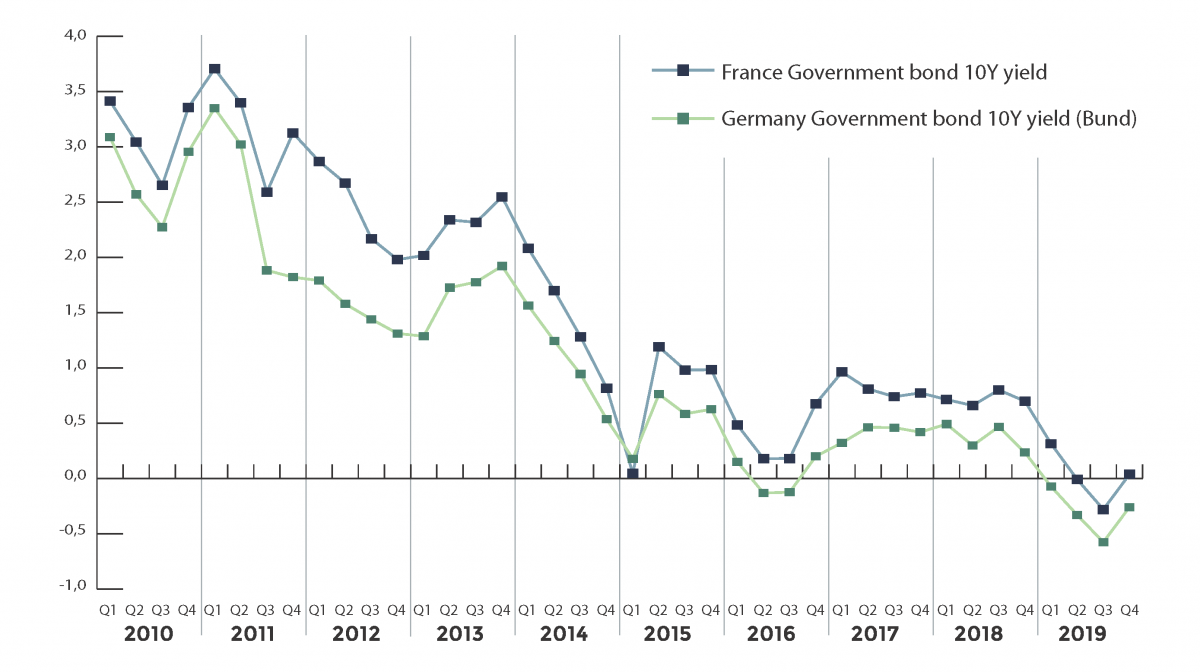

In 2010, betting on a rate cut was not bold (+/- 3% on the 10 Year German Bond).

But who would have thought that this decline would go to zero levels, and even to negative levels since 2018, including on corporate bonds categorized as investment grade? Indeed, more than half of the bonds issued in the world today bear negative yields: the lender is paying the borrower, and this goes against financial theories. This trend is confirmed and should not disappear anytime soon; it is now necessary to adapt to and manage this reality. Especially since new emissions generate savings on the payment of the state’s debt, it will be even more difficult for central banks to raise rates substantially in the future. AMFIE’s former strategy for cash management, which mainly consisted in keeping bonds until final redemption, no longer generates sufficient returns to enable the Association to offer attractive results.

AMFIE’s former strategy for cash management, which mainly consisted in keeping bonds until maturity, no longer generates sufficient returns to enable the Association to offer attractive results. Indeed, since the end of December 2018, interest rate volatility as a result of uncertainty related to Brexit, the Sino-American trade agreement and even the Coronavirus, has led us to substantially modify our management strategy because the traditional “Buy & Hold” approach was no longer suitable.

A flexible and active approach inthe allocation of capital between the different types of investments (authorised within the framework of our Discretionary management mandate) makes sense in a low-yield environment.

Here are some examples of investments:

Funds among the “Investment Grade” (IG) segment:

- Nordea 1 European Covered Bond -BI Base Currency

- Pimco Global Investors - Euro Bonds DIS

Bonds:

- NIBCAP 0 7/8 07/08/25

- BANQUE Intl 1 1/2 09/28/23

Investment in real estate funds (“Core” categorised funds = Investment Grade):

- Aberdeen Standard European Balanced Property Fund (real estate funds for business / logistics)

- Aberdeen Standard Pan European Residential Property Fund (residential real estate funds).

These investments have enabled us to generate substantial performance, without investing in the "High Yield" (speculative segment), while complying with our Mandate's framework.

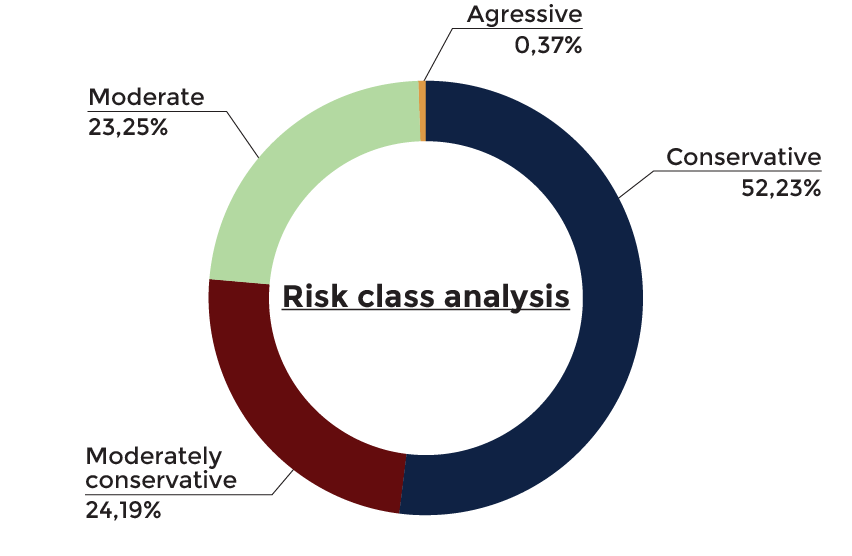

We also strive to comply with a rigorous risk management process for volatility below 3%. The change to our overall investment strategy helped deliver a performance in 2019 of Euro 2.49%, USD 5.31%, GBP 6.71% and CHF 3.20%.

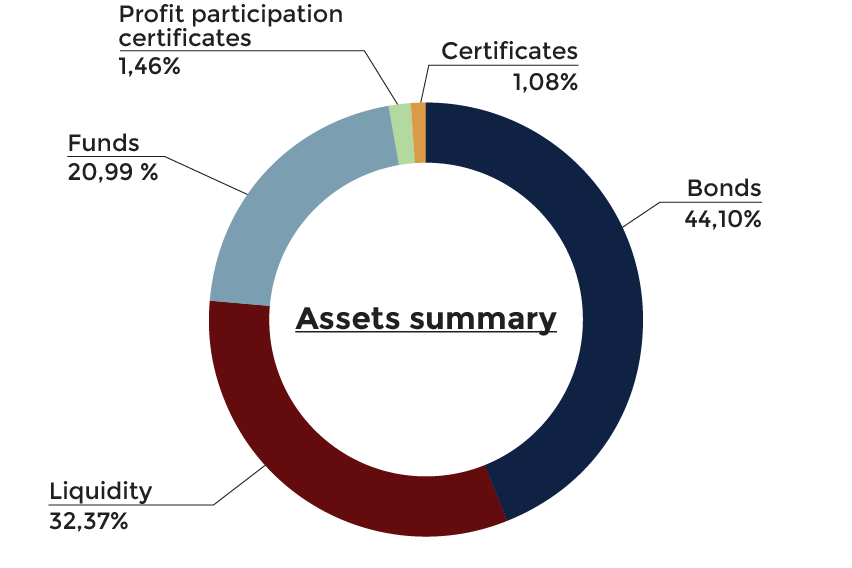

We currently have a relatively defensive, diversified portfolio with an average bond rating of A3.

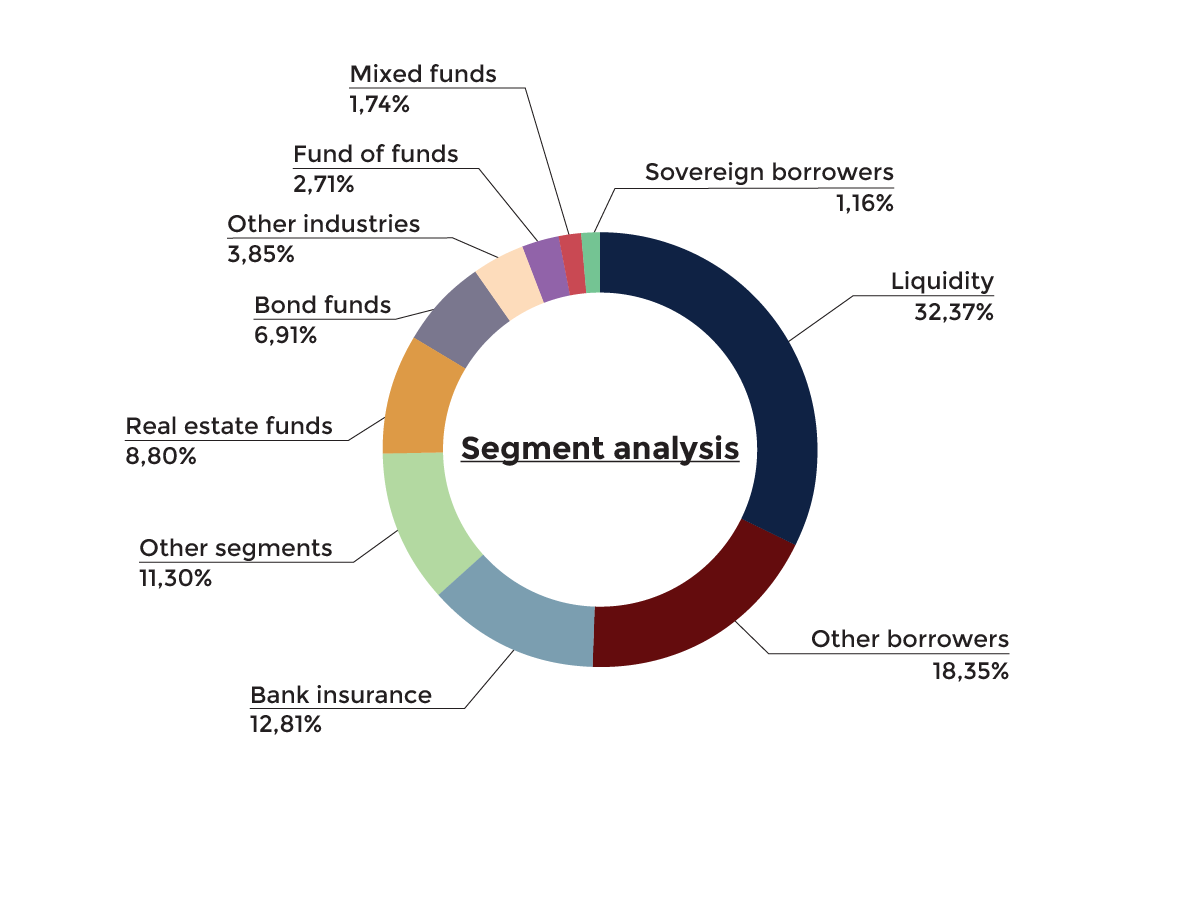

Segment allocation

Diversification: Exposure to the universe of bonds across two sectors: Seniority and Currency.

Granularity: No Bond/Mutual Fund has an exposure that exceeds 5% of total assets under management.

Risk/Reward: 100% exposure in the “investment grade” category.

Geopolitical conflicts were the main cause of volatility for the 2019 interest rate market. However, 2020 seems to offer moderate growth perspectives. Hence, it is necessary to take into account the existence of credit risk, as well as possible intervention by central banks, which should remain limited in the event of a crisis. We will stay on this course, with prudent cash management that will favor a diversification of investment products with acceptable volatility, rather than looking for potentially higher returns.